Turning 65? Make Medicare a Piece of Cake

| 55 or older? Save up to 10% towards your automobile for taking the Mature Driver Class Lower Your Auto Insurance Payments By Up To 15% A Year With Our DMV Approved Mature Driver Course! |

| The driver must be a Good driver to qualify for the discount. The course is a participation course not pass/fail. There is currently a promotion for Farmers’ insured, use promo code Farmers15 https://www.maturedrivertuneup.com/?msclkid=cbc8e3dd6b43176b479ebd7115f3fbe2 |

Tuesday, December 3, 2019

Learn more about the SCAN health plan, a Medicare Advantage plan

9:30am Scripps AMP

9898 Genesee Avenue, La Jolla, CA

Call Mike to reserve a space!

This was the first time since 2007 that more than 40,000 people died in motor vehicle crashes in a single year, according to the National Safety Council.

By Denny Jacob | March 02, 2017 at 07:01 PM

According to the National Safety Council, traffic deaths increased 6 percent to 40,200 — the first time since 2007 that more than 40,000 have died in motor vehicle crashes in a single year.

The 2016 total follows a 7 percent rise in 2015. Much of this is attributed to continued lower gasoline prices and an improving economy which has increased motor-vehicle mileage.

In addition, the U.S. Department of Transportation’s early estimates show the motor vehicle traffic fatalities for the first nine months of 2016 increased about 8 percent as compared to the motor vehicle traffic fatalities for the first nine months of 2015. Preliminary data reported by the Federal Highway Administration (FHWA) shows that vehicle miles traveled (VMT) in the first nine months of 2016 increased about 3 percent.

All 10 National Highway Traffic Safety Administration (NHTSA) regions experienced increases during the first nine months of 2016. In particular, the South, Southeast and Northeast saw motor vehicle traffic fatalities spike between 11 and 20 percent alone.

Here are 5 factors contributing to the increase in auto accident rates:

As the economy grows and gas and diesel remain cheap, drivers can expect heavy congestion and more cars on the road. (Photo: Shutterstock)

More cars on the road and miles driven today

Cheap gas and diesel, plus a stronger economy, has caused high road density with more cars on the road. The Department of Transportation’s Federal Highway Administration shows that driving jumped 3.5 percent over 2015, the largest uptick in more than a decade. Americans drove more than 3.15 trillion miles, equivalent to around 337 round trips from Earth to Pluto. The previous record, around 3 trillion miles, was set in 2007.

As drivers divert attention from the road to their phone, they create greater risks for themselves and everyone around them. (Photo: Shutterstock)

More distractions

Beyond texting and driving, from Bluetooth to Snapchat, approximately 660,000 drivers are attempting to use their phones while behind the wheel of an automobile. On top of that, we now have sensors and technologies that respond to our every move in vehicles. We have apps that connect to center consoles and more touch-screen technology in vehicles than ever before.

Along with their inexperience, millennial drivers are more likely to ignore the rules of the road, which can lead to more auto accidents overall. (Photo: Shutterstock)

Younger, more inexperienced drivers

A new study from AAA Foundation for Traffic Safety show that millennial drivers (more 19- to 39-year-old drivers) are texting, speeding and running red lights. They also think it’s OK to speed in school zones. While the statistics improve for older drivers, it’s not by much. From a commercial driver standpoint, the experience (or inexperience) of drivers can lead to more auto accidents overall.

The overall cost of car repair is more expensive as enhanced technology is required to ensure car functionality and optimization. (Photo: Shutterstock)

Cost of car repair more expensive

Think about your grandfather’s car. If the engine blew, you went to a mechanic who fixed the problem. Now, everything in a car is connected by a computer. If one fuse blows, it will likely have an impact on other parts of the vehicle. Yes, computers make it easier and quicker to fix, but overall costs tend to be higher, especially because cars on the road are much newer.

Ultimately, we pay for the technology (computers, advancements in bodywork, HVAC, etc.). To diagnose many computer issues and the dozens of sensors requires a scan tool that is capable of accessing the thousands of manufacturer-specific trouble codes and data streams. A good one can cost $7,000 alone.

The cost of medical care has increased as more than 35 percent of spinal cord injuries are caused by vehicle accidents. (Source: Shutterstock)

Injury costs from accidents on the rise

No surprise, the cost of medical care has increased, most of which are spinal and soft tissue injuries. According to the Mayo Clinic, more than 35 percent of spinal cord injuries are caused by vehicle accidents (truck, automobile, or motorcycle). Think about this — medical spending for spinal care per patient increased by 95 percent from $487 to $950 between 1999 to 2008, accounting for inflation.

But think about the full picture, which compounds the issue. You get whiplash (direct medical cost), have to stay home for a few weeks (loss of income) and get physical therapy (cost of post-injury medical care — according to one estimate, about 25 percent of whiplash injury patients end up suffering chronic pain). The costs can triple from an economic and quality-of-life perspective, costing the U.S. $2.7 billion per year.

JUN 14, 2017 | BY DENNY JACOB, PROPERTYCASUALTY360

A moving violation can affect your premium for three to five years, so here’s what drivers should ask their insurance agents. (Photo: Shutterstock)

A moving violation ticket will leave a bitter taste in any driver’s mouth.

They will spike a driver’s auto insurance premium, and many come with hefty financial penalties. But depending on the violation or which state the driver is located, it could be an extremely burdensome on a driver’s wallet.

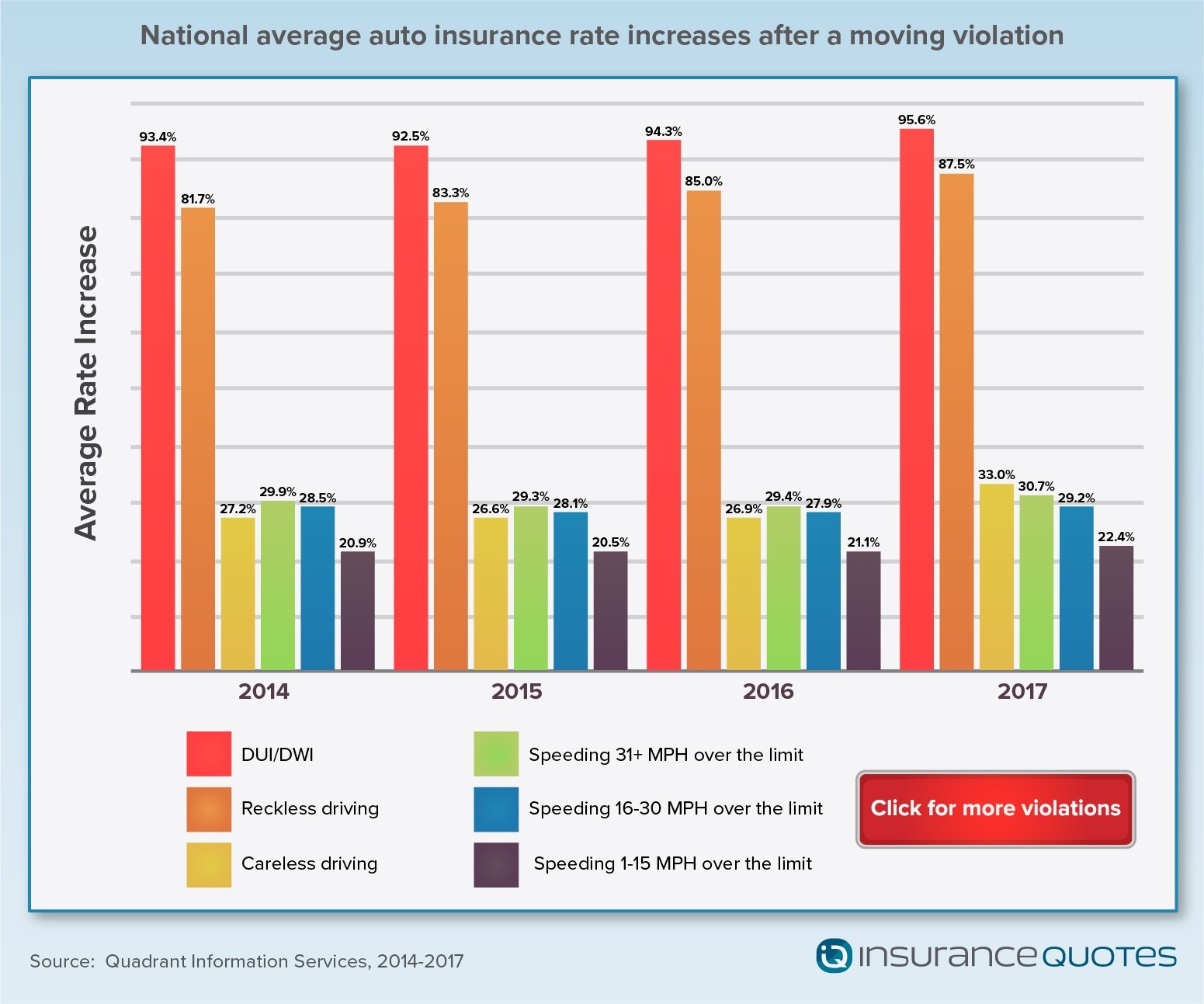

For the fourth consecutive year, insuranceQuotes commissioned a Quadrant Information Services study that found car insurance premiums can climb by as much as 96% after a single moving violation on average nationwide.

The study analyzed the average national premium increase for one moving violation in 21 different categories, including careless driving, reckless driving, driving under the influence and speeding. As in years past, the study found the economic impact on one’s insurance premium varies significantly among different types of violations and among different states.

Here are some of the study’s key findings along with some advice on what you can do after a moving violation to keep your rates as low as possible:

DUI/DWI produce the highest rate increases over the last four years while speeding 1-15 miles per hour over the limit produce the lowest rate increase. (Photo: insuranceQuotes)

Take, for instance, the difference between reckless and careless driving.

According to Robert Nevo, a former Georgia police officer and current owner of Nevo Driving Academy, careless driving is usually defined as “a minor lapse in judgment,” such as following too closely to the vehicle in front of you. Reckless driving, however, concerns more “intentional acts,” such as driving in a way that shows no regard for the safety of others.

“Moving violations are typically weighted with a point system. This makes an excessive speeding violation much more severe than, say, a broken taillight violation,” said Nevo. “Insurance companies often see more points against a driver’s license as an increased risk. Therefore, you’re going to see higher premiums for that driver.”

Across the country, premium increases are directly affected by where the driver lives. (Photo: Shutterstock)

Whether it’s a minor or major offense, your wallet will feel the toll.

According to the National Association of Insurance Commissioners (NAIC), the average annual U.S. auto insurance premium is $866. That means an 88% premium spike for one reckless driving offense will result in an increase of just more than $750 per year.

Even relatively “minor” infractions, such as following too close or not yielding to a pedestrian, can mean paying an average of $260 more per year for car insurance. Driving under the influence carries an expensive insurance penalty, with a single infraction resulting in an average premium spike of $1,086.

Across the 50 states, depending on the moving violation, premiums can increase by high percentages or very little. (Photo: Shutterstock)

The impact on your auto insurance premium largely depends on where you live.

For instance, a first-time DUI conviction in North Carolina will result in an average premium increase of 298% (in Hawaii it’s 209%, 187% in California, and 165% in Michigan). Meanwhile, the same violation in Maryland will only result in an average premium increase of 21%.

Perhaps the starkest difference can be seen in a violation for failure to wear a seatbelt.

In North Carolina, just one ticket for this infraction will result in an average premium increase of 27% (22% in Oregon and 20% in Utah). Meanwhile, in 32 states this particular violation moves the premium needle by less than 5%, including seven states where it has no impact on the premium price at all.

While a moving violating will affect your premium, there are options drivers can discuss with insurance agents to save money. (Photo: Shutterstock)

While your premium will be impacted for quite some time, the moving violation will eventually be erased from your driving record. How long you’ll feel the increased premium’s impact depends on the severity of the violation as well as the individual state laws. Here are some tips for the bumpy times ahead.

Seek forgiveness: If this your first moving violation, especially a minor one such as a failure to signal, talk to your auto insurer. They’re typically going to be somewhat forgiving for a small infraction. Take advantage of any driving classes your state might be offering to remove one or two moving violations from your record.

Make a deal: If your violation isn’t too severe, look for a plea bargain when your day at traffic court is due.

Shop around: Shopping for a new car insurance policy after receiving a traffic moving violation may also be a good idea, though it’s unlikely you’ll be able to hide the violation altogether.

Wait it out: Eventually, your driving record will go back to its original clean slate, but that could take anywhere between three to five years.

Home water damage comes from many different sources, is classified in different ways, and falls under different areas of coverage.

For instance, natural flooding is considered to be very different from standard water damage and is covered under separate policies. When you’re confronted with a claim, here are some of the things you need to look for to judge the matter correctly according to the policy.

This is by far the most important distinction. Homeowners insurance is meant to cover sudden unexpected damage to a home. The trouble with water damage is that it can hide for quite a long time before it becomes apparent. This leads to conflicts about whether or not the original cause of the damage was gradual or sudden.

For instance, discovering a crack in a foundation might be a cause for a claim. But if the crack wasn’t found and water seeps into the basement and causes damage that might not be covered because it was gradual. Another example is a slow faucet leak under a sink. If the cabinet floor underneath the sink gets damaged, that’s gradual.

Determining the fate of soft contents after a catastrophe involves more than an educated guess.

Examples of sudden damage include a pipe breaking in a freeze that leads to a huge flood, or a tree poking a hole into the roof of a home after falling and letting storm water in. But these can also lead to secondary damage that doesn’t show up till much later, which can create conflicts with policyholders.

If the smashed roof was repaired, but soaked insulation wasn’t remedied, mold could develop and lead to another claim. A common example is a sudden failure of an appliance. A washer in a dishwasher might gradually fail, but once it does the damage can be sudden.

The policy will be the guide about whether or not this secondary damage can be covered or not. For instance, some states require insurance companies to cover secondary mold damage due to a legitimate water damage claim. It’s up to adjusters to know the exceptions and to understand exactly what the policy covers.

Most homeowners policies will cover sudden water damage except in one major case, flooding. Flooding is not covered by most homeowner’s policies. It requires separate flood insurance. So, how is flooding defined?

In the most general sense, once water from a natural source (e.g., a river or the sky) touches the ground, it is then considered flood water. Your insurance company may put in other restrictions, but this is the core difference. This is why storm water falling in from a hole in the roof is covered by some policies, but a swollen river washing away a porch is not.

However, most homeowners are not conversant with this difference. It is common to say that a room is flooded when there is water all over the floor, and this can set off alarm bells for insurance adjusters. Adjusters have to get a clear idea of where the water came from and why before adjusting a claim. Too many simply hear the word flood and automatically deny it.

Deciding which category a claim falls into is tricky, but acquiring evidence is the same as any other claim. Ask for home maintenance records, photos, and descriptions of what the homeowner did before and after the incident.

Interview any professionals including water damage professionals who worked on the situation prior to your examination. Ask if any cleanup work was done and what preventative measures the policyholder took to prevent further damage. From there, it’s just a matter of using your expertise and the wording of the policy to know whether or not the claim is covered.

Michael Jacobs is the head of the public relations department at ServiceProsLocal.com, with a primary focus on customer satisfaction. He focuses on water damage restoration, environmental friendly house building and plant cultivation. Contact him at michael@serviceproslocal.com.

Insurance fraud is not simply the act of people taking advantage of a faceless corporation, as the ethically challenged may claim. It costs all Americans through increased premiums, and it can take a much worse toll in some cases – even potentially resulting in death.

Auto Insurance Fraud Is on the Rise

According to the National Insurance Crime Bureau (NICB), auto insurance is the greatest component of overall insurance fraud. In the 2013 NICB report, suspected cases of auto insurance fraud rose 12.7% from 2011 to 2012, reaching a nationwide total of 78,024. This raised the three-year total from 2010 to 2012 to over 209,000 questionable claims (QCs).

To put this in perspective, auto-related QCs during 2012 were over four and a half times more prevalent than the next highest category (17,183 homeowner’s personal property QCs) and almost seventeen and a half times more than the third place category (workers compensation, including employer’s liability).

Studies estimate almost 25% of the bodily injury claims related to auto crashes are bogus. Property and casualty claims against auto insurance are not much better, coming in at around a 10% fraud rate.

The NICB estimates the direct cost to you at around $200-$300 per year extra tacked onto your premium. The indirect costs are likely to be far more than that, estimated at around $1,000 per family according to the Texas Department of Insurance.

The indirect costs are not always obvious, but they are significant. For example, some portion of the prices you pay for goods and services is devoted to covering the inflated insurance costs of the business – and for fraud schemes, businesses are even more tempting targets than individuals.

Estimates vary on the overall cost, but the Coalition Against Insurance Fraud puts the cost of fraudulent claims in the range of $80 billion annually. Claims tend to rise during difficult economic times, and the recent recession was no different.

Types of Fraudulent Claims

What is the nature of all of these bogus claims? Auto insurance fraud is typically broken into two classifications – “hard” and “soft”.

Hard fraud occurs when an insurable event is either staged or fabricated outright. This includes scams such as phony hit and run accidents, triggered rear-end collisions, and fake car thefts.

Soft fraud refers to inflating a legitimate claim to cover nonexistent or unrelated charges. Examples include claiming damage from a previous event or racking up unjustified medical expenses claiming the wreck was at fault. Underwriting fraud, or misrepresenting your insurance information to lower your premiums, may also be considered a form of soft fraud.

The Auxiliary Dangers

In the case of auto insurance fraud, hard fraud is on a significant increase and staged accidents account for the greatest part of it. Staged accidents often involve innocent people who happen to be in the wrong place at the wrong time and get inadvertently caught up in a staged collision or a subsequent chain reaction.

There have been multiple cases of injuries and deaths from staged accidents that spiral out of control, and people have been successfully prosecuted as a result. Unfortunately, that does not bring back the deceased or heal the disabled.

Help Stop Auto Insurance Fraud

If you suspect auto insurance fraud, or any other type of insurance fraud, the has a toll-free hotline (1-800-835-6422 or 1-800 TEL-NICB) that you can call to report the fraud anonymously for further investigation. We hope that you never find yourself in this situation – but if you do, please be part of the solution and not part of the problem.

CNBC: Published: Monday, 8 Jul 2013 | 7:35 AM ET

US Relaxes Health Law Income, Insurance Status Rule for Exchanges

7:35 AM ET

Days after delaying health insurance requirements for employers, the Obama administration has decided to roll back requirements for new state online insurance marketplaces to verify the income and health coverage status of people who apply for subsidized coverage.

President Barack Obama’s healthcare reform law is slated to begin offering health coverage through state marketplaces, or exchanges, beginning October 1. But to receive tax subsidies to help buy insurance, enrollees must have incomes ranging from 100 percent to 400 percent of the federal poverty line and not have access to affordable insurance through an employer.

Until now, the administration had proposed that exchanges verify whether new applicants receive employer-sponsored insurance benefits through random checks. It also sought to require marketplaces to verify each enrollee’s income status.

Play Video on CNBC, see link at bottom of article

Obamacare: Too Much, Too Fast?

William George, Harvard Business School professor, discusses the impact of delaying the healthcare mandate for businesses. A lot of disruption is going to take place for small businesses, in particular, he says.

But final regulations released quietly on Friday by the Department of Health and Human Services (HHS) give 16 states and the District of Columbia, which are setting up their own exchanges, until 2015 to begin random sampling of enrollees’ employer-insurance status. The rules also allow only random— rather than comprehensive—checks on income eligibility in 2014.

The changes, which point to new technical and bureaucratic challenges at the state and federal levels, raise new questions about the how successfully Obama’s Patient Protection and Affordable Care Act will be implemented. The law is scheduled to go into effect on Jan. 1. But the administration’s latest move acknowledges that exchanges need extra time to get their verification systems in place.

Less than a week ago, the administration also announced that it would not require employers with 50 workers or more to provide insurance benefits until 2015, a one-year delay that stirred speculation about the possibility of further delays.

The regulations, contained in a 606-page HHS rule, allowed state-run exchanges to accept an enrollee’s “attestation regarding enrollment in an eligible employer-sponsored plan.” Marketplaces to be operated by the federal government in 34 states will still make random checks to verify applicant insurance status in 2014, it said.

“For income verification, for the first year of operations, we are providing (state and federal) exchanges with temporarily expanded discretion to accept an attestation of projected annual household income without further verification,” the rule said.

Full Story:

http://www.cnbc.com/id/100869332

When it comes to car insurance, cheap isn’t always better. Find out why…

By Chris Kyle

Are you looking to cut costs on your car insurance? Here’s some advice: Proceed with caution. Cheap auto insurance could actually end up costing you more down the road.

“Nobody should shop for auto insurance by price alone,” says Jeanne Salvatore, senior vice president of public affairs for the Insurance Information Institute (III), an organization dedicated to improving public understanding of the insurance industry.

“You want to get a great price that comes with great service,” Salvatore says. “It’s a balancing act.” To help you make an informed decision, we’ve outlined five potential pitfalls of cheap auto insurance. Keep reading to learn why the lowest insurance rates can end up costing you big-time in the long run…

#1 – You’re probably not getting the coverage you need

Okay, so after some digging, you found a cheap quote on a car insurance policy. But do you know what’s covered in the policy – and more importantly, what’s not?

In most states you need some liability insurance, which covers the damage you cause to others or to property in the event of an accident, to legally drive. So, make sure you know your state’s minimum coverage requirement.

However, collision and comprehensive coverage – which covers your car in the event of an accident, theft, vandalism, fire, and weather-related disasters like floods – is not required by law in the United States, according to the National Association of Insurance Commissioners’ (NAIC) website, which helps regulate insurance requirements.

Do you want protection from these types of accidents? If so, you can expect your rate to rise accordingly.

#2 – Your low-priced deductible payment could lead to higher costs

One popular way to save on car insurance is to opt for a higher deductible, the amount you pay out-of-pocket before your insurance kicks in, according to “How Can I Save Money on Auto Insurance?” an article on the III’s website.

This could help reduce your premium because you are agreeing to pay a set amount (perhaps the first $1,000) on any future claims.

The danger is that if you are unlucky enough to have several accidents, this strategy can quickly become an expensive one.

You should take a look at your finances and make a realistic assessment of what you can afford. A $1,000 deductible may not make sense if you don’t have that kind of money handy in case you need repairs. On the other hand, a higher deductible could make sense for low-risk drivers who rarely get behind the wheel.

The important thing here is to be honest about what kind of protection you need.

#3 – Bad customer service is bad news, even if your policy is cheap

You know the old adage about how the customer is always right? We all know that’s not true. However, it is reasonable to expect prompt and courteous responses to your questions and concerns.

“You want to find a company with a really good reputation for customer service,” Salvatore says.

Salvatore urges consumers to ask friends and family members for recommendations, just like you would do if you wanted a doctor or dentist referral. Ask if they have filed a claim with their company and how it went.

#4 – Friends may not be covered on a cheap policy

Hey, you’re a nice guy or gal. Sometimes you let a friend borrow your car. But is he or she covered?

“Perhaps,” writes the Ohio Department of Insurance in a consumer guide on the Ohio state’s website. “Some liability policies cover a licensed driver who drives with your permission, while other policies state specifically that no other person is covered when driving your car.”

And in a related hypothetical situation, what if you borrow a friend’s car?

Whether you live in Ohio – or elsewhere – you owe it to yourself to find out the answers to these questions now. Don’t wait until after you or a friend get into an accident to find out that your cheap policy has some holes in it.

#5 – You need to watch out for cheap insurance scams

If a cheap car insurance quote sounds too good to be true, it probably is. In fact, it may even be fake. Potential red flags can include dirt cheap rates as well as companies and agents who are difficult to reach.

In 2011, some Detroit-area drivers were scammed into buying low-cost, bogus auto insurance through a company called Ethos, according to Michigan’s Department of Licensing and Regulatory Affairs website.

Fortunately, insurance companies and their agents must be licensed in the state that you live, so verification is usually only a quick phone call away to your local insurance department. And while auto insurance scams can be uncommon, it’s better to be safe than sorry.

Here is a PDF you can print out and put in your car in case you get in an accident.

Accident Card – keep in your glovebox!